Financial markets go up and down daily. This can cause a lot of anxiety for investors. Am I going to lose all of my invested money? Am I making the wrong choices? The right ones? This stress is further heightened by the media constantly yelling at us to BUY or SELL stocks as if the next big crash is only moments away.

We love the analogy of the stock market behaving like someone going up the stairs with a yo-yo. If you focus on the yo-yo (short term), you might think the stock market is going up and down constantly. If you focus on the staircase (the intermediate and long-term), however, the market has trended upward.

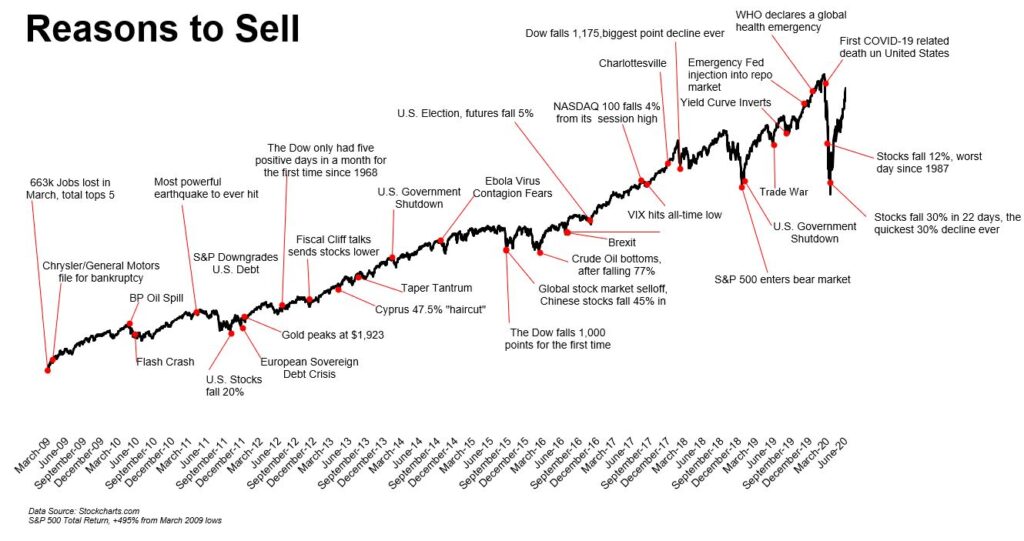

We understand the frustration. The media talks about the “yo-yo” every day, making it really hard to focus on the long-term success of your portfolio. Not many people will talk to you about how exciting a case of stairs looks. There’s a good chance they’ll want to talk to you about a cool yo-yo move, though. The graphic below helps to illustrate this:

So, what should you do if you notice a large flux in your portfolio? First off, stay calm. When building out your financial plan it’s important to remember that the “yo-yo” movements and day-to-day changes will happen. They’re a function of the markets and a reality of the industry! Instead, turn your attention to the staircase and keep climbing, one stair at a time. If you have questions about your portfolio or financial goals, don’t be afraid to reach out to us – we’re here to help!

Disclaimer: Although the markets have historically grown over time, there is no guarantee that this will continue in the future.