RE: Graham Powell Question

Graham: What are some of the variables that I should consider when assessing whether to remove some of the equity from my home and use it for other investment purposes?

Thank you for this question Graham. It seems as though you can’t open a newspaper in Canada these days without reading statements such as “overpriced housing markets”, “real estate bubble”, coupled with “Canadians having record amounts of debt”. These can be scary headlines to read when assessing our country on a macroeconomic level. With this being said, the idea of utilizing equity in a home for other investment purposes is a topic that can be evaluated based on your individual situation. The discussion should address all areas of your financial plan when assessing the potential of implementing any type of leverage strategy and the risks should be well understood beforehand.

The reason why it can make sense to utilize home equity is because the accumulated amount does not benefit the owner until the asset is sold and the money can be invested. Therefore, leveraging this equity is a way to put this asset to work while retaining ownership of the property. On the other hand, some of our clients who are uncomfortable with leveraging their home equity have chosen to downsize or sell their home instead. The capital is then used to supplement their retirement lifestyle or invest for future use. Typically this makes sense when approaching retirement, as the size of their home is larger than what they require.

With all this being said, here are three things that we think are important to consider when deciding to leverage the equity in your home:

- What is your motivation for accessing the equity in your home? Is it to capitalize on the current market situation either in the stock market or real estate market? If so, I would wave caution… market fluctuations are very difficult, nay, impossible to predict in the short term. If this is a long play, it is worth evaluating further.

- If you did nothing, is that okay too? When conducting financial planning, the absence of action can still be an option. We have experienced situations where people have made up their mind before doing any type of financial evaluation. This prevents us from being completely honest with ourselves in regards to making an objective and informed decision.

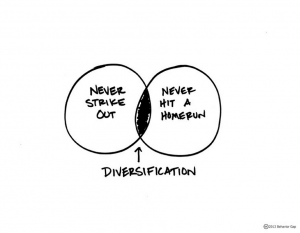

- The topic of diversification is not limited to how many stocks you own in comparison to bonds. It encompasses everything you do in your financial life. From how much cash you hold, to the real estate you own, to the different forms of income you earn. It all counts and each variable should not be looked at in isolation.

Lastly, one more thing to consider: when doing a little web research on this topic I found numerous websites promoting investing in real estate and/or how to access the equity in your home. Make sure that when you are getting advice on this subject that it is coming from an objective source. Anytime someone has advice for what you should do without taking the time to know your specific situation and future plans they are not looking out for your best interest.

Remember, if you have found this or any other blog topic interesting, don’t be shy and reach out to us at info@tcmfinancial.ca for further discussion, comments or questions.

-Taylor